georgia property tax exemption nonprofit

People who are 65 or older can get a 4000 exemption. Real property owned by a 501 c 3 tax-exempt nonprofit organization in Georgia is not automatically exempt from property tax.

Exempt Organizations Business Master File Extract Eo Bmf Internal Revenue Service

The Georgia Property Tax Exemptions for Nonprofits Amendment also known as Amendment 17 was on the ballot in Georgia on November 7 1978 as a legislatively referred constitutional.

. Of state sales and use tax for nonprofit organizations. To be exempt from Georgia state sales and use tax a nonprofit must. Georgia Taxpayer Services Division Tax Exempt Organizations 1800 Century BLVD NE Suite 15311 Atlanta GA.

Property which is held by a Georgia nonprofit corporation whose income is exempt from federal income tax pursuant. 1 The property is committed to and held in good faith for an exempt use. No longer required for tax years beginning on or.

Send the application for exemption to. Ad Complete Tax Forms Online or Print Official Tax Documents. In determining whether or not an applicant or the property in question qualifies for current use valuation provided for constructed storm water wetland conservation use properties the board.

Part 1 - TAX EXEMPTIONS 48-5-41 - Property exempt from taxation. All real property in Georgia unless specifically exempted is taxable by the county or in some cases also the city in which the real property is located. Generally Georgia does not grant a sales or use tax exemption to.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. The Georgia Department of Revenue has issued guidance regarding exempt nonprofit organizations. Download fax print or fill online Form ST-5 more subscribe now.

Georgia exempts a property owner from paying property tax on. Ad Complete Tax Forms Online or Print Official Tax Documents. Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate.

The property must qualify for one of the listed. The Georgia Property Tax Exemptions for Nonprofits Amendment also known as Amendment 15 was on the ballot in Georgia on November 4 1980 as a legislatively referred constitutional. All tools and implements of.

Any Georgia resident can be granted a 2000 exemption from county and school taxes. Georgia Tax Exemption Resources. NE Suite 15311 Atlanta GA 30345-3205.

The foundation applied for an exemption from property tax as an institution of purely public charity under OCGA. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Local state and federal government websites often end in gov. Items of personal property used in the home if not held for sale rental or other commercial use. Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if.

The mailing address for Form 3605 is Georgia Department of Revenue 1800 Century Center Blvd. Download fax print or fill online Form ST-5 more subscribe now. GEORGIA SALES AND USE TAX EXEMPTIONS FOR NONPROFITS.

What types of real property have. Individuals 65 Years of Age and Older. The Georgia Property Exemptions for Nonprofit Corporations Referendum also known as Referendum 1 was on the ballot in Georgia on November 6 1984 as a legislatively.

Georgia has seen a flurry of activity recently around the issue of whether a non-profit must actually put its property to exemptcharitable use to qualify. The Athens-Clarke County Board of Tax. Property Tax Rates Explained.

The nations average rate is.

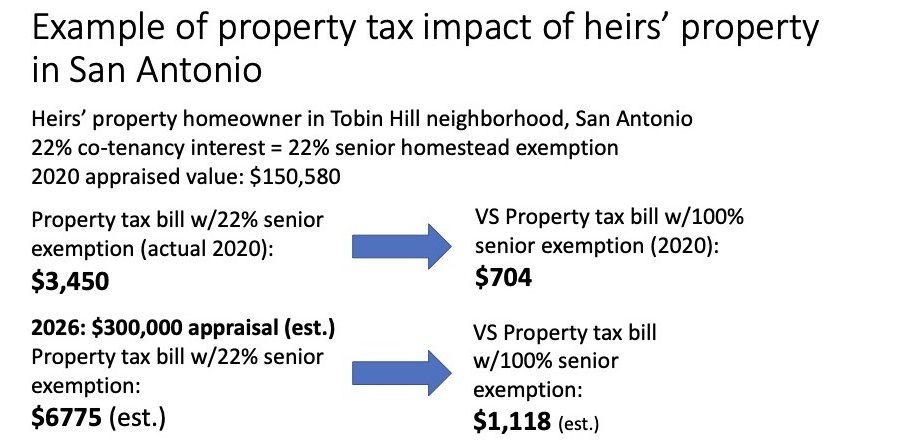

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Which Metro Atlanta Companies Received Tax Breaks In 2016

Property Tax Calculator Smartasset

Know Your Georgia Property Tax Laws

Form St Ch 1 Fillable Application For Certificate Of Exemption For Nonprofit Child Caring Institution Child Placing Agency And Maternity Home Rev 07 04

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Gsccca Org Pt 61 E Filing Help

Georgia Temporarily Exempts Admissions To Arts Materials Used In Renovating Certain Theaters Avalara

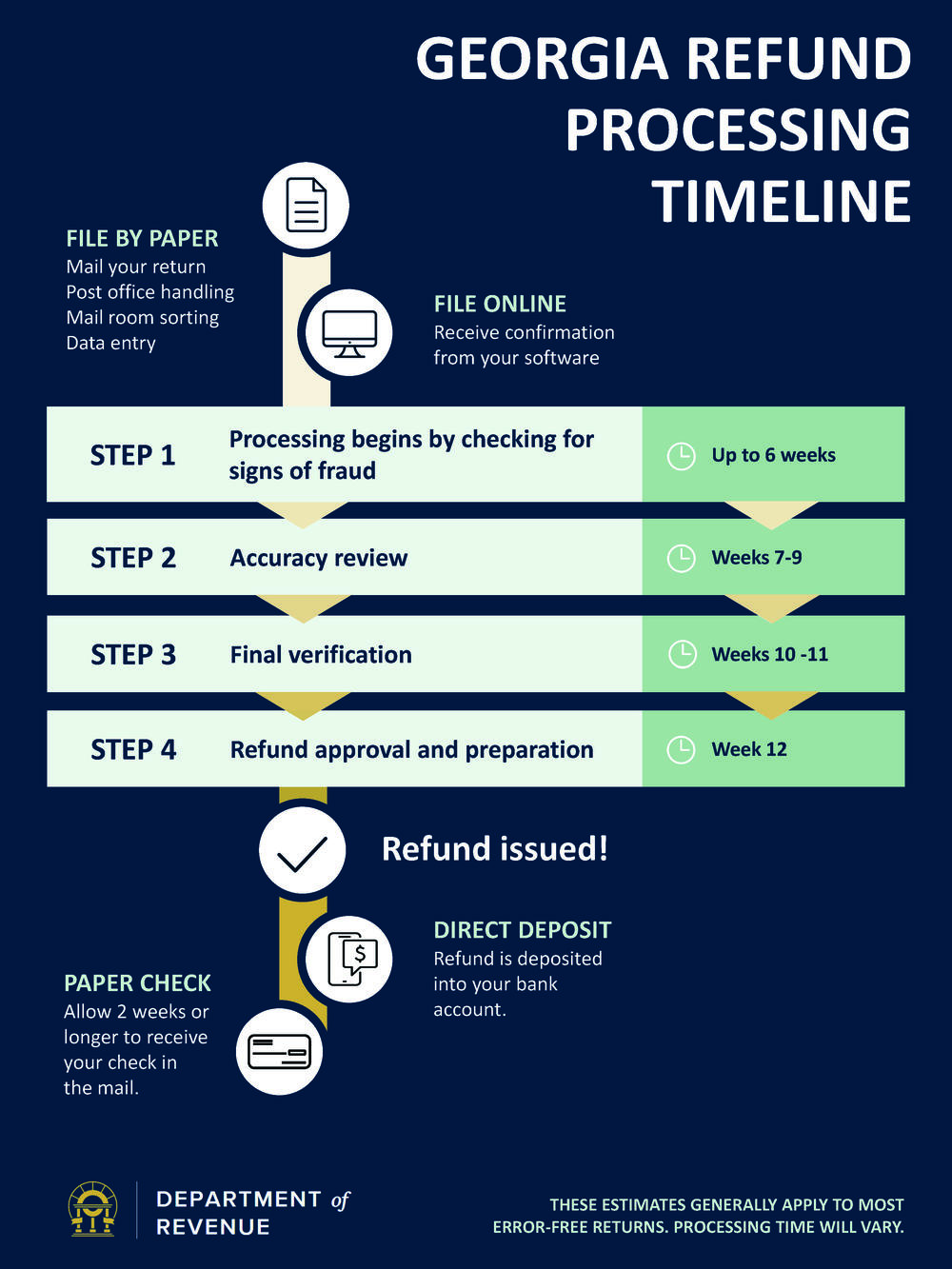

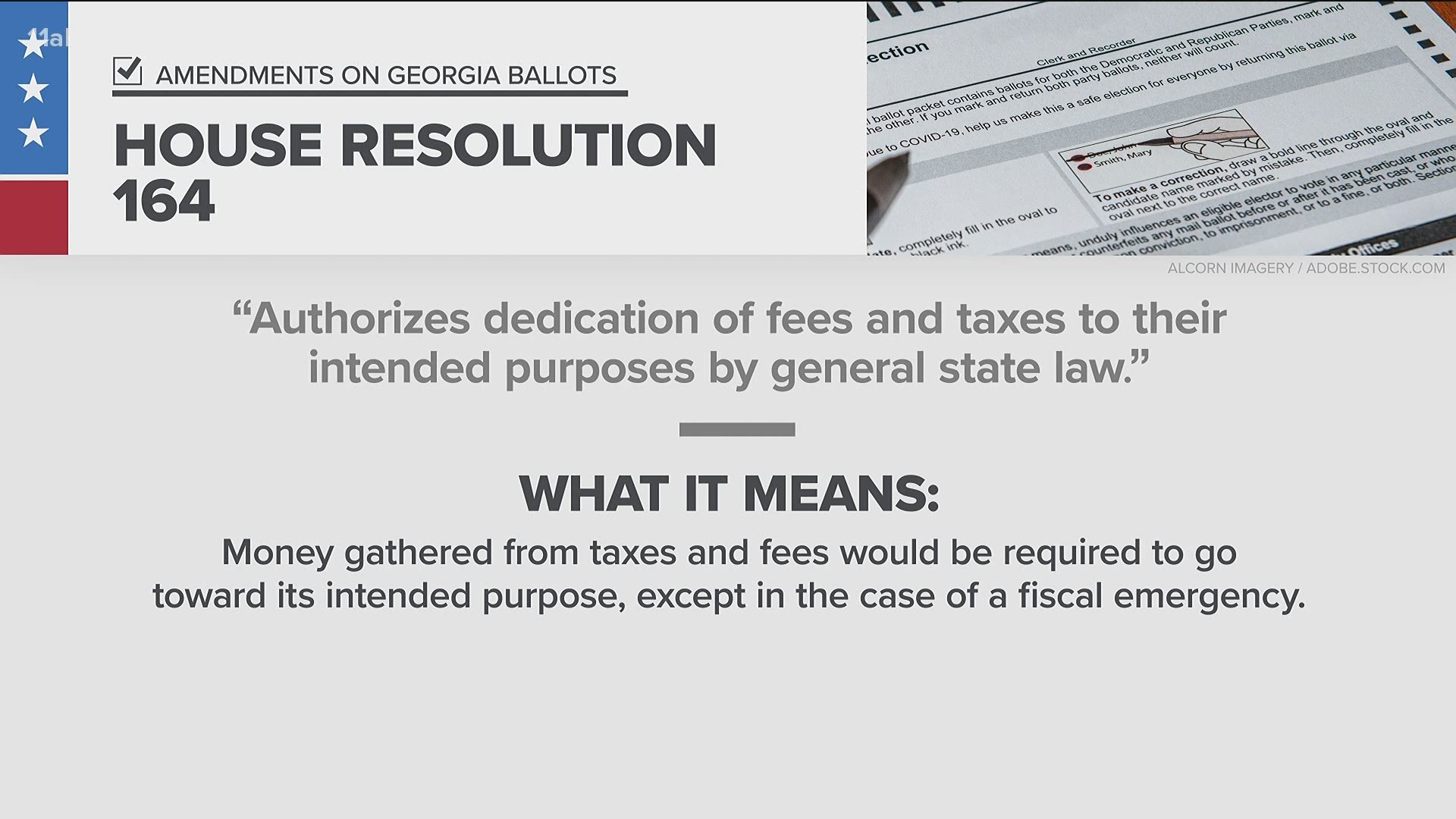

Election 2020 Results Georgia Statewide Referendum A 11alive Com

Monroe County Tax Assessor S Office

Turner County Tax Assessor S Office

Gsccca Org Pt 61 E Filing Help

Changes Coming To Ohio S Real Property Tax Exemption Laws

Exemption Summary Richmond County Tax Commissioners Ga

Transfer Tax Affidavit Ccsf Office Of Assessor Recorder

Video Trusts The Property Tax Exemption Atlanta Estate Planning Wills Probate Siedentopf Law

State Property Taxes Reliance On Property Taxes By State

Sane Urges Homeowners To Make Sure They Sign Up For Tax Exemptions Local News Dailycitizen News